OEM Profitability Is Up; Is Yours?

This is article is part of a series of monthly articles produced by Harbour Results for PMA’s MetalForming Business Edge e-newsletter. Click here to view the full collection of articles.

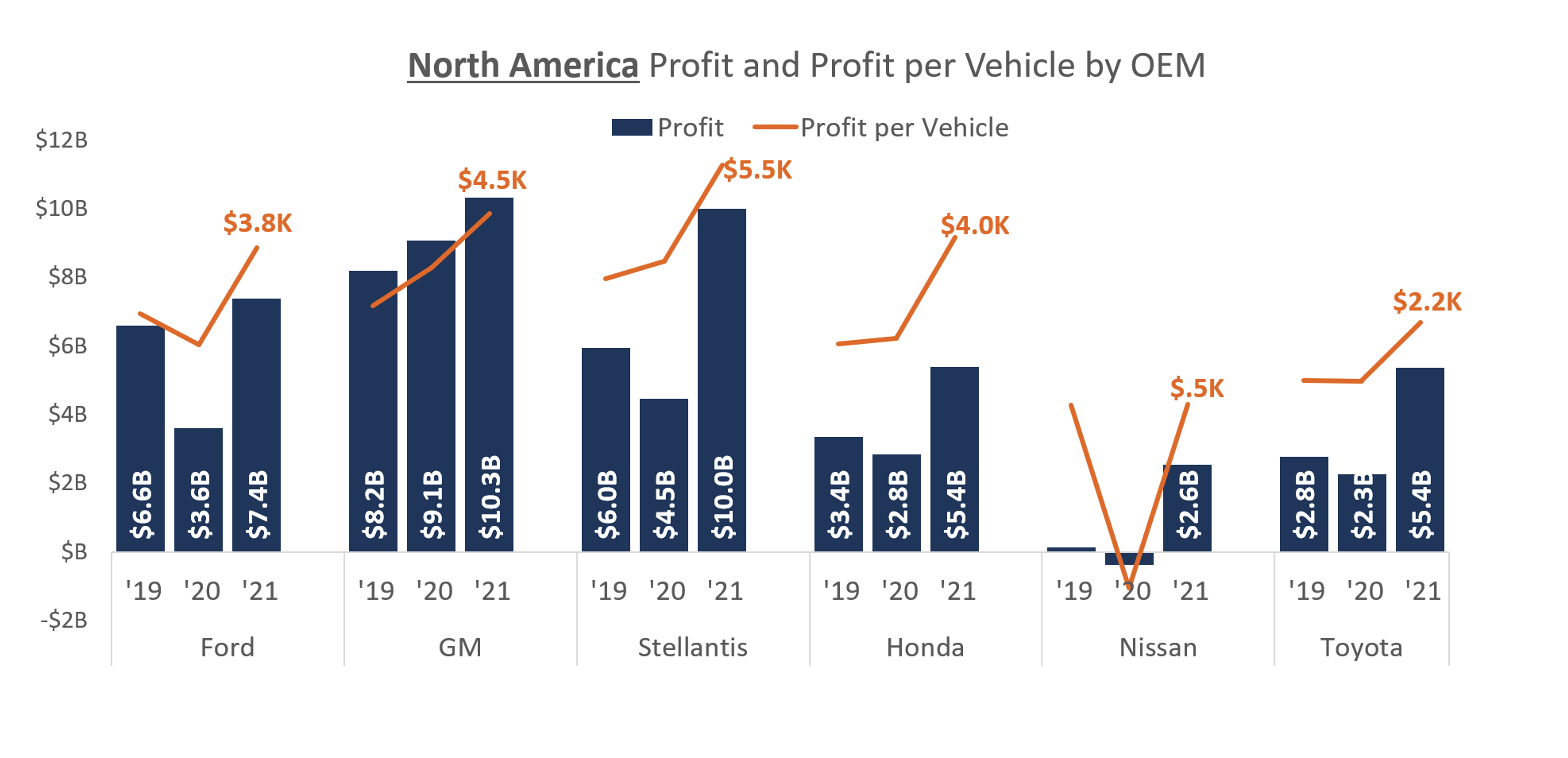

The automotive industry – specifically the automakers – continue to see benefits from the growing demand for new cars. OEM profitability is always an important factor for metalformers. It signals the health in the automotive industry. High OEM profitability means that your end customer is doing better financially, and consumers are buying vehicles, even at the substantially higher price points they are seeing today. Many OEMs saw profits in 2020 and so we wanted to take a closer look at 2021 financials.

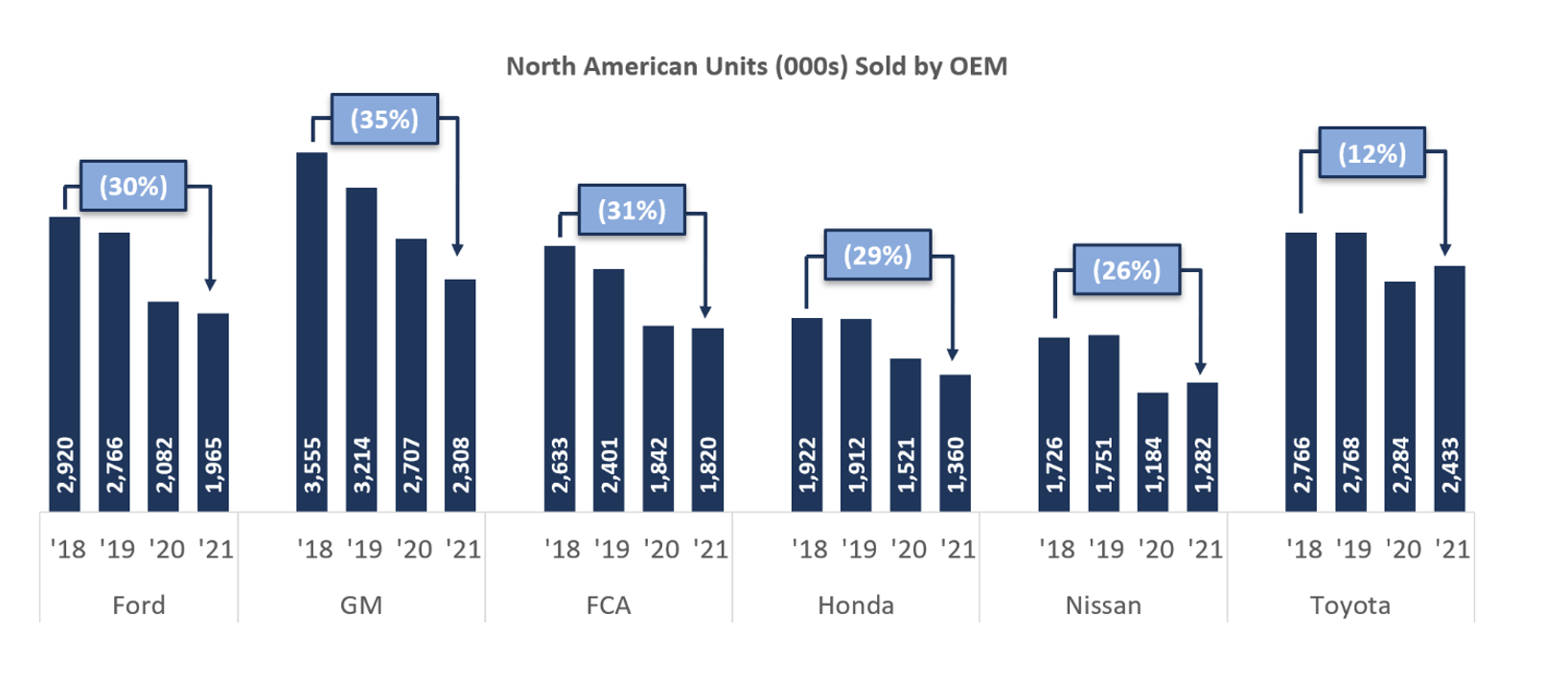

Automotive OEM fourth quarter earnings and 2021 calendar year financials have been released for Ford, GM and Stellantis over the last 6 weeks. Additionally, Asian OEMs released their third quarter fiscal year earnings. Across all traditional OEMs, volumes continued to remain low in North America while profitability soared to levels higher than 2019 for most. Similar to third quarter earnings results, OEMs cited minimal incentives and positive vehicle mix as the two key reasons for improved profitability.

Although OEMs are making more money, they are not using profits to increase volumes across the board. Unfortunately for stampers, OEM 2021 earnings make it clear that OEMs have figured out how to make money with lower inventories.

Let’s Take a Closer Look

Ford, Stellantis and Honda saw the largest year-over-year increases in profit per vehicle, more than $2,000 USD increase per vehicle.

Ford specifically cited the benefit that allocating components such as semiconductors to their high-demand and high-profit vehicles - Bronco, Maverick and F-series – had a big positive impact on their bottom line.

Stellantis cited down volumes due to discontinuation of Dodge Grand Caravan and Dodge Journey. Both of these lower-profit vehicles were offset by increased sales of the 2021 Jeep and Wagoneer as well as higher Ram volumes, all much higher profit vehicles. These two factors played a key role in improving Stellantis’ profit per vehicle in North America.

Although General Motors’ profit per vehicle and overall profit did not improve as dramatically as many others, their baseline of earnings in 2020 outpaced any other North American OEM. Their consistent growth from both a net profit and profit per vehicle perspective can be attributed to a continued focus on prioritizing more profitable and more in-demand products, such as their trucks and full-size SUVs.

Asian OEMs continue to be impacted by supply chain issues however, their lower profit in comparison to the Detroit Three has to do with vehicle mix. They make far more cars than SUVs or trucks in North America. Additionally, the trucks they do sell do not sell at the same volume levels as the Detroit 3. Nissan continues to dig themselves out of a whole from their prior challenging years impacting their performance.

What Does the Future Hold?

Automotive OEMs generally forecasted higher profitability targets in 2022 on similar topline volume levels. The key to 2022 is that OEMs will continue to focus on the vehicles in their fleet that are the most profitable and most attractive to consumers. For many OEMs the most sought-after vehicles continue to be trucks and full-size SUVs, which means continued demand for many suppliers. Unfortunately, on-going supply chain challenges will likely continue to affect the industry with production fits and starts as semiconductor and global supply chain challenges continue throughout 2022.

The best option for stampers is to continue working on their businesses and focus on flexibility. Along with increased flexibility, it is important to be aware of what programs your parts are ending up on if possible, stay informed on which programs OEMs will likely continue prioritizing.

About the Author

This article was written in collaboration with Cara Walton, Director at Harbour Results, Inc. She is responsible for managing the company’s Harbour IQ business intelligence tool, which provides data and intelligence to North American manufacturing companies.